These are exciting times for providers of financial services. The past decade has seen immense economic activity, and the world is reaping its benefits.

Banks are looking at anything that can help them reduce costs and increase revenue within their existing business paradigm. It is an exciting time because firms are testing different revenue streams to develop improved revenue models through low-cost services that solve the pain points of existing customers.

The Fintech revolution is amping up, and some of the top fintech companies are finding ways to recapture the market share that traditional banks once enjoyed successfully. These new fintech business models will be looked back upon and banks can learn from them how to make money.

P2P Lending

In the past decade, a new phenomenon has emerged in the banking world: peer-to-peer lending (P2PL). This concept connects individuals who want to borrow with individuals looking to invest.

To help borrowers and lenders connect, websites have been created that match the two parties to make financial transactions more efficient.

What’s excellent about Peer-to-peer lending platforms is that they’re a win-win for everyone. Banks and other financial institutions get a new way to make money, and borrowers get access to better loan terms than ever before.

Another advantage for lenders on P2P lending platforms is that they can expect consistent returns. Because the returns on this model are higher than those available in the debt markets. FinTech software companies may contribute to the improvement of the commercial loan market by creating platforms that connect multiple lenders to borrowers and collect fees for the repayment process. Such as Peerform.

Cryptocurrencies

The growth of digital currencies such as Bitcoin has placed pressure on banks to adapt their business practices. When Bitcoin first appeared on the market in 2009, it shook the fundamentals of how traditional money functioned.

However, the interruption caused other financial institutions to sit up and take note. Since then, a slew of new blockchain-based digital currencies has emerged, opening new avenues for investors to profit from cryptocurrencies — with or without banks!

Success is ensured by altering the flow of transactions, profits, and growth. Every time a user performs a transaction on your platform, you may be charged a fee. You can also reward your customers for bringing in new customers by offering them a commission for each new customer they recommend.

With their capacity to disrupt the conventional banking sector, cryptocurrencies and blockchain technology have caught the interest of fintech startups and banks. Banks are adjusting by incorporating blockchain technology into their current operations. With these new technologies at hand, revenue models and business models are continually being reinvented at a quick rate.

Related: Your Product could Make $1.4 B With Tinder Revenue Models

Digital Wallets

Digital e-wallet business models can generate revenue in different ways. Paypal generates revenue by charging transaction fees for every transaction made via their payment platforms. Other companies charge fees in monthly subscription fees or annual membership fees.

E-wallets can also generate revenue by issuing credit to the owners of their accounts. While e-wallet companies may be able to generate revenue through various methods, they are all ultimately focused on generating revenue by creating value for the customer.

Payments are made via a computerized system. Business models of fintech firms give the convenience of contactless payments for customers in exchange for a very low merchant discount rate, which is often applied to businesses rather than consumers (MDR). In addition, these payment platforms make money by offering their users access to third-party financial services.

Related: Customer Experience in Fintech

Crowdfunding

The crowdfunding trend has been around for a while, but it has lately acquired traction. The growth of social media and the internet is a crucial factor. It is now simpler than ever to fundraise online.

Kickstarter crowdfunding is a means for individuals who believe in a business concept to become involved. It includes raising funds for initiatives or financial organizations. Smaller sums of money are collected from a larger audience to help fund a product or project.

Typically, the funds obtained in this manner are used to create a certain service or product. Profit-sharing is another variation, in which members make actual contributions in return for future profits.

Payment Gateways

Today, you can make money transfers, pay utility bills and even buy a house with a single click. Of course, none of this would be possible without a payment gateway. Payment gateways are an essential part of e-commerce. They allow customers to pay for any commodity or make money transfers online using credit cards or their bank accounts.

Contrary to popular belief, payment gateways are not limited to allowing people to pay for their online purchases. You can use it for multiple purposes.

For example, suppose you have a blog to publish your articles and allow readers to comment on your work. In that case, you need some gateway to make payments for commenting privileges or subscriptions. You can even use them to receive payments from freelance jobs and services offered on your website or blog.

Smaller Loans Sanctioning Services

The fintech industry collects financial services-related concepts, technology, and business strategies. This industry’s technology is assisting in keeping the banking sector ahead of the competition. New fintech company concepts are emerging to provide innovative approaches to the financial services market.

A modest loan sanctioning service is one such business concept. Sanctioning Services for Smaller Loans, Some fintech businesses have devised novel approaches to meet the demands of small borrowers to serve their target demographic. They can provide speedier loan disbursement at cheap interest rates by giving smaller loans to their consumers.

Robo-advising

Robo-advisors are platforms that manage money automatically and offer their clients financial advice on demand. They use AI, machine learning, and other technologies to analyze and predict market trends.

While most Robo investment advisors offer some human oversight and investment advice, there is an emerging class of automated investment platforms that are entirely algorithm-based. These platforms, called Robo-advisors, use automated computer programs to determine the optimal asset allocation based on a client’s risk tolerance, investment goals, and financial situation.

A percentage of the total assets under management may be charged as a fee for portfolio management. At a far lower cost, advisory robot platforms provide the same services as human advisors. Robotic insurance advisors and expenses are paid for by charging a portion of the user’s assets.

Asset Management Platforms

The fintech business models are different from that of banks in that it does not rely on spread cost. The return on investment or profit margin served to measure the success of a bank’s performance. The fintech businesses are based on transaction fees, which means that their revenue is directly proportional to volume.

Every asset exchange is an engine to create and capture value for the community. In a value-based economy, the asset exchange becomes the platform that provides the tools to create value for yourself and monetize it for your users.

When building an asset management platform, there are several options to consider. These include a subscription, tiered pricing, and transaction fee-based models. All these models have their approach to the business.

For example, if you run an asset management platform and choose a subscription-based pricing model for your product, then it is likely that you will charge your users monthly. You can also add features that allow you to customize the parts of your product or even offer free services for a lifetime.

On the other hand, if you run an AUM-based pricing model, then it is likely that you will charge your users based on their assets under management (AUM). However, this does not mean you cannot trust them for additional services. You can build any feature into your product and charge them for it. For example, if your platform offers social networking features as an add-on, you can set a fee for using those features.

Insurance Underwriting

Insurance underwriting is a business that estimates your chance of dying from an illness or accident. If you’re more likely to die, your premium will be higher than someone who doesn’t have the same risk factors.

We’ve all heard the cliche that age and gender are used to calculate premiums. But there are other factors that insurance underwriters consider, such as smoking habits and alcohol consumption.

Today, many startups use technology to improve the process and make it fairer for everyone. They consider fitness level, driving behaviour, and unquantifiable traits like willpower.

Related: 10 Must-Have Fintech App Features for More Sales and Growth

Alternative Credit Score System

Everyone has their own story to tell. Yours may not be that different from the next person’s. It’s easy to try and hide your past, but it will surely come out when it comes time for a loan or credit.

Moreover, many startups are still at a very nascent stage where they require funds to get their product up and running. However, they may not be in a position to provide a range of documents like audited financials and board minutes that prove their creditworthiness to lenders.

Here is where alternative credit scoring systems can come to the rescue. It offers special services for startups and individuals to get them the cash they need without worrying about their credit scores. Alternative credit score systems can help you in various ways. One of them is that it can help you get loans from banks that are hesitant to lend money to you.

Money Transfers

This business model has been around for many decades. However, the way funds are transferred changed significantly over the years. Banks used to be the only places where people could send or receive money, but payday lending and other services have also become popular.

The rise of online-based businesses is changing the process of transferring money in various ways.

For example, online companies often provide better exchange rates than their traditional counterparts. The speed of cash delivery is also much faster with these companies, which makes them extremely popular among consumers. The fees associated with these types of transfers are also lower, which means that both parties involved walk away from the transaction happier than they would be otherwise.

Many online-based businesses rely on product sales as their primary source of revenue rather than charging consumers for their services. It means that there is no need for them to advertise heavily to attract customers to their website.

Money transfer can be complex and confusing through an old-fashioned bank or another service provider. However, it’s pretty easy to complete an international transfer using an online-based business model because most people are already familiar with how this type of business works and what is required to transfer funds successfully.

Digital Banking Applications

Digital banking applications are services designed to make the banking and financial transactions of the customers more manageable, more convenient, and accessible via smartphones or online.

Online banking applications consist of an integrated system that allows clients to make transactions from different devices without visiting a bank branch. Digital banking provides both a personal finance app and a business bank account for the clients, making it possible to manage the funds.

The essential functions of digital banking include payments via a smartphone, money transfers between accounts and cards, ATM withdrawals, mobile deposits, online bill payment, and monitoring of stock investments.

Fintech companies are also developing apps for clients who like to use smartphones or tablets as their primary internet devices. Such apps offer convenience and allow people to get rid of paper documents since everything can be done online now: managing checking.

Other online investment platforms have taken this trend a step further. Online investment platform Robinhood offers commission-free stock trading for individual and institutional investors. However, they can profit from interest rate spreads.

With more than three million users on their platform, Robinhood has proven to be a highly disruptive company in the financial industry. Their unique business model has attracted several investors attracted by the lack of commissions charged on every trade.

Investment Platforms

Investors prefer investing via online investment platforms as they don’t have to pay trading fees. Although the price investors pay for stocks is slightly higher than the stocks’ actual price, the amount they save is significantly higher than the trading fee they’d pay via conventional means.

Tied into its business model is how Robinhood makes money. The company doesn’t charge its customers any commissions on every trade they make. Instead, it makes money from interest rate spreads and selling items from its premium services like Robinhood Gold (a margin feature) and Robinhood Crypto (an option for cryptocurrency trading).

Neo Banks

Banks have to deal with a lot of operational and compliance costs. For instance, they have to pay for branches and open accounts manually. They also can get a lot of pain points like a security breach, hacking, etc.

Neo Banks (operating entirely online) solves the above problems. It is the next-generation banking platform, which is based on blockchain technology. The neo bank has all the features of a regular bank, but it costs less than half because they don’t need any infrastructure like branches and employees. They don’t have any detailed account opening process because of the automation in their operations.

The customers only need a smartphone or tablet to access their accounts anywhere in the world. They can also use it for cash-free payments & P2P transfers at low transaction fees.

Neo banks are consistently profitable, even though most are still in their early stages of growth. They only focus on what they do best and outsource everything else to partners like Amazon, Google, etc. And because they operate at lower costs, they always have more money to lend at lower rates which is just one reason why neo banks will change the future of banking as we know it.

InsurTech

Businesses are demanding more from their insurance providers than just the promise of a payout in the event of an unforeseen catastrophe. They want to know it will look you after a claim and that they will have access to claims lawyers and help if something goes wrong.

It might be why fintech companies like Lemonade are flourishing in the insurance market. Lemonade is a direct-to-consumer insurance company that provides customers with affordable policies and helps them recover their losses faster.

Fintech is transforming the insurance sector in more ways than one. Traditional players are upgrading their infrastructure with the latest technology, while startups like Lemonade are making significant strides by offering personalized services at affordable costs.

API’s as a Revenue Stream

Fintech business models are making waves by disrupting the financial services sector. Banks have long been the primary financial institutions in a country, but technology has made it possible for startups to provide similar services.

With APIs, FinTech companies can create products offered to banks and other institutions by putting their revenue model inside a business model. Let’s look at an example.

With APIs, FinTech companies can create products offered to banks and other institutions by putting their revenue model inside a business model. Let’s look at an example.

FinTech company A is trying to find a way to make money from advertisements and doesn’t want to deal with banks directly. So they approach FinTech company B, which provides services to banks. They partner with FinTech company B, which sets up an API integration.

Another source of revenue for FinTech firms is charging merchants and other businesses to utilize their financial infrastructure. Over the next several years, this will be an intriguing trend to watch.

Third-Parties

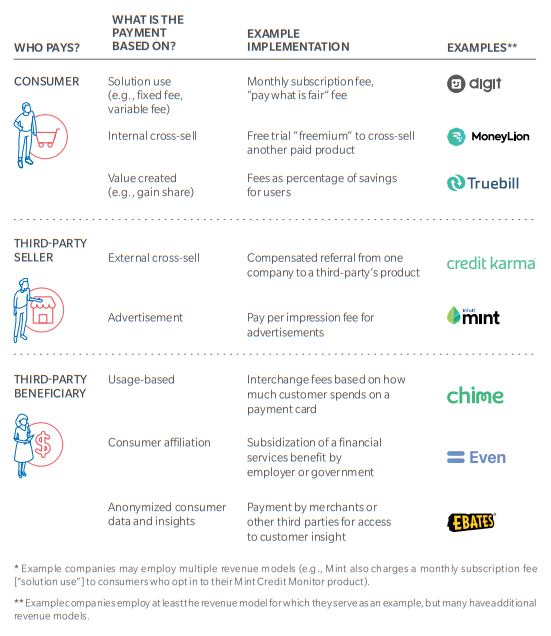

Fintech companies are not just about making financial solutions available to the masses. They are also focused on making money by employing an effective revenue model.

Revenue models have been a major driving factor for FinTech companies’ growth and popularity. There is no shortage of them, but some of the most popular ones include:

Provide value via other means. It is among the most lucrative and effective revenue strategies for FinTech companies. With this mode, the FinTech companies partner with other third-party institutions to offer value via other means. For instance, a FinTech solution can also provide health insurance, credit scoring, accounting services, and many more.

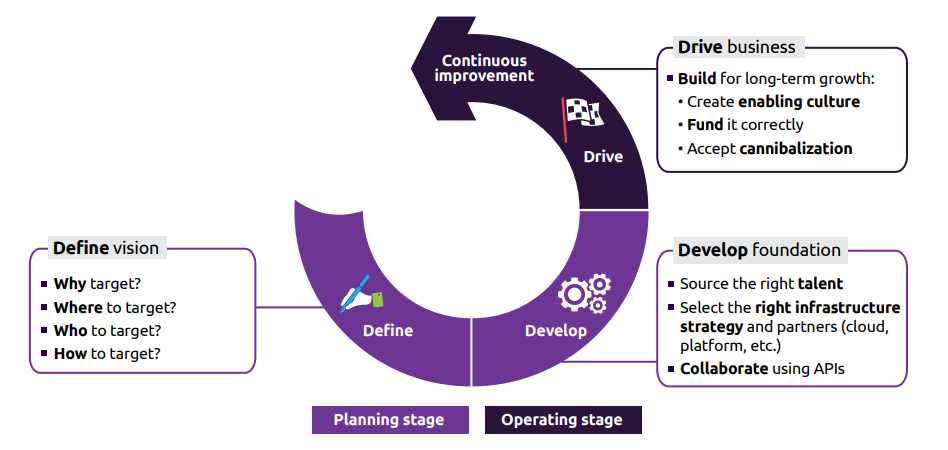

The concept is very straightforward. FinTech directs the customers to third-party services, and in return, the third-party service provider offers a certain percentage to the FinTech company or gets paid for every transaction. Source. Breaking new ground in Fintech -Oliver Wyman

Source. Breaking new ground in Fintech -Oliver Wyman

With this revenue model, the FinTech company focuses on offering value through its product/service offerings while partnering with other companies and entities for additional income generation. For example, Intuit’s QuickBooks has partnered with tax service providers to provide its customers with all their tax needs under one roof.

Subscription-Based

An example of a subscription-based business is that of Netflix. This is one of the most prevalent types of models employed by mobile developers. The user pays a predetermined cost on a monthly or yearly basis in exchange for access to premium features in the app under this business model.

It is the subscription model that is the most often used method of monetization for FinTech companies. The amount invoiced to each customer is determined by the frequency of billing (monthly, quarterly, or annually).

Advertising

Digital advertising has found a home in apps. Ads are a simple and straightforward way to monetize applications and generate revenue. Ad networks pay the app owner for displaying their adverts on the app, and the app owner does nothing more than that.

Every time an ad is clicked, you get compensated. It is possible to publicize your funding application in partnership with a chosen group of financial institutions such as lenders, merchants, and banking experts. Your personal financial app may make money with banner and multimedia adverts in this FinTech business model.

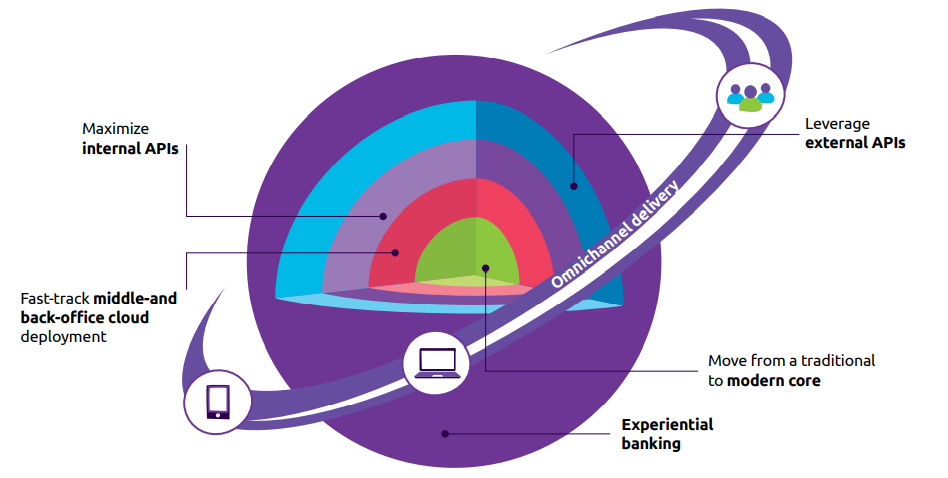

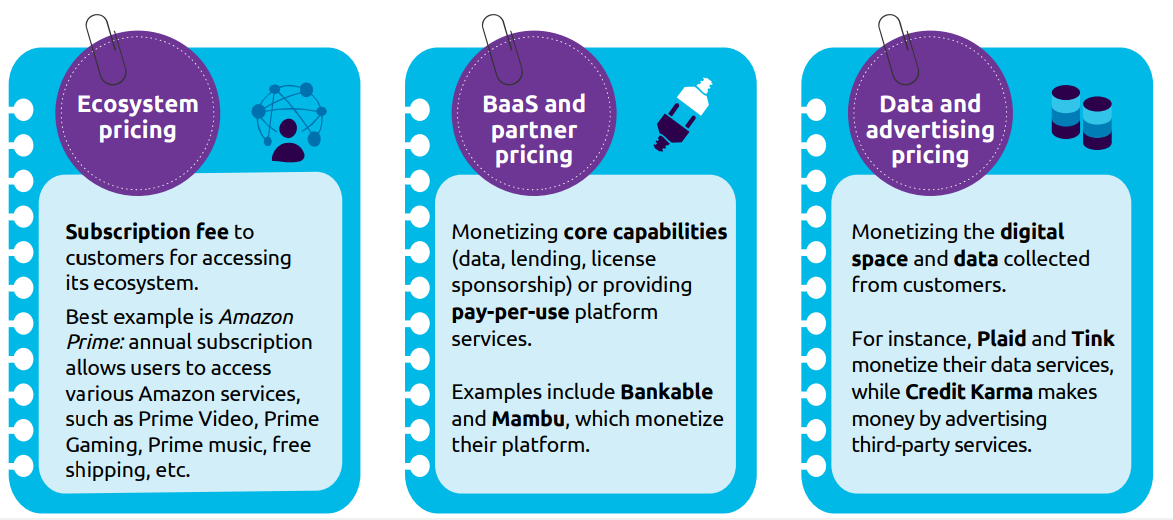

Source: World Fintech Report- By Capgemini Research Institute

Source: World Fintech Report- By Capgemini Research Institute

Conclusion

Overall, being successful in the FinTech industry is based on a few things, from having the best product available to having a business model and strategy that works for you. Make sure you go into your project with as much information as possible and solid goals for your fintech software development market.

Epiprodux.com is a revolutionizing Fin-BI solution that combines the best of digital banking. Join us now for a free trial on your Epiprodux platform. We offer the greatest financial tools to elevate your brand.