Construction is a booming industry that has grown over the years, with many renovations and new projects. However, a lot of people in the construction industry are worried about the profit margins. They think that it is a really low margin business. The profit margin is typically between 4% to 0.5% depending on the type of project and value added services provided.

Measuring project profitability is a crucial component of running a successful construction business. Whether you’re a contractor, architect, or engineer, the bottom line is a profitable project.

At Epiprodux, we help our clients improve their profit margins by using our cost-estimating software, which is designed to help project managers estimate accurate costs early in the design process. In this article, we’ll discuss ways that you can improve your project profitability with Epiprodux.

What Is Project Profitability?

Project profitability is the amount of money a project makes or loses. It’s a valuable metric to determine whether you should continue working on a project or if it’s time to cut your losses and move on.

Profitable projects are those that have achieved their goals with little or no additional effort after the initial investment. Profitability is essential because it indicates both how efficient your team is and how well you’ve managed risk.

The value of a successful project lies in its ability to meet its objectives within budget and on time. To measure this, you must first determine what your objectives are. These can be simple, such as building a single unit of housing, or complex, such as developing an entire community.

Project profitability is calculated by taking the total revenue of a project and subtracting the total costs associated with delivering the project.

Why Is Project Profitability Important?

The most apparent reason for tracking project profitability is that it helps you make better business decisions. If you’re running a profitable project, you can increase your team size and confidently expand your operations. However, if your projects are losing money, you need to take action immediately before things get worse.

You’ll also want to know how much profit each project generates so that you can evaluate where your strengths and weaknesses lie as an organization — and make improvements where necessary.

How to Measure Project Profitability

There is no single formula to calculate project profitability. The best way to gauge a project’s profitability is to use multiple formulas that focus on different aspects of your business.

In this article, we will discuss the three most common ways to measure the profitability of a project:

Evaluate More Than the Budget

Evaluating the profitability of a project can be challenging. It requires understanding the business case and determining whether the project will likely generate a positive return on investment (ROI). Evaluating the profitability of a project also requires comparing costs to benefits.

The best way to evaluate the profitability of a project is by using a process known as “cost-benefit analysis.” Profitability analysis helps you determine whether a particular project is worth pursuing or not by measuring its impact on profits or sales revenue. This can help you decide if it’s worth taking on that new customer, investing in new technology, or expanding your operations.

Start Early

Most people will tell you that it’s essential to start early when it comes to estimating projects and building schedules. This is because, as time goes on, more things can change and affect your project schedule. Things like:

- Changes in scope or requirements

- Adding new features

- Changing priorities and deadlines

- Changes in team member availability

The earlier you measure a project’s profitability, the better informed your decision will be. You can use any method available to you at the time, but always keep in mind that it will get easier as you learn more about measuring profit or loss on a project.

Always Track

Tracking is essential for managing a project successfully. If you don’t track your progress, you won’t know where to allocate resources or make changes to improve profitability.

Tracking means keeping track of how much work has been done, how much time it takes, and what the cost is. This way, you can see if you’re on track and if something needs to be changed.

This information will also help you decide whether or not the project should continue. If things are going well, keep going. If they aren’t going well, find out why and fix it before it’s too late!

Track what?

There are many different things to track project profitability and measure in a project. Here are some of the most common ones:

- Time — How long does each step take? How much time has elapsed so far? How much time remains? How much time should remain?

- Cost — What does all this cost? What will it cost if we keep going at this rate? Is there enough budget left for us to complete this phase (or sub-phase)? Should we stop now or wait until next month/quarter/year?

- Scope — What’s included in this phase (or sub-phase)? Do we have everything we need yet, or are there still some gaps (that need to be filled)

Start by tracking your costs and revenue during each project phase to measure profitability. Then compare these numbers with those from previous projects that were similar in scope and length. This will allow you to see how much profit each phase has generated so far — and whether or not it’s enough at this point in time.

Project Profitability Analysis

Consulting businesses with promising project concepts should evaluate their potential for a profit before and throughout development. The profitability index formula is beneficial, but a profitability analysis report gives the team additional information.

If a project is not profitable, a product manager may learn how to turn it around with the aid of a project profitability report template. An examination of a project’s profitability involves more than merely tallying up the dollars and cents.

Managers of said projects would do well to study said example to get a feel for how said project analysis report ought to look. Specifically, it will outline the amount of time and money spent on labor and supplies, the amount of money made from the project, and the difference between the two.

The profitability of a project may be evaluated in many ways by businesses. One possibility is using a pre-made Excel template for a project’s profitability study. A software-based project profitability report may be generated with the help of QuickBooks Online. EpiProdux, on the other hand, can automatically provide comprehensive reports in real-time for businesses.

Profitability Index

Sometimes referred to as a profit investment ratio or return on investment (ROI), a project profitability index (PI) measures the success of a project. It helps gauge the likely financial return on an endeavor.

The profitability index for a project is the sum of the present value of the cash flows expected from the project and the original investment in the project. That’s how much you make for each dollar you put in.

A project’s profitability index greater than one indicates the potential for a positive return on investment. If it’s less than one, it’s safe to assume the project won’t succeed. The direct costs associated with this endeavor will far outweigh any potential returns. You probably won’t take on a venture of this kind.

A profitability rating of one indicates that the project will likely break even. While not a loss, that’s not exactly what most businesses aim for. It’s hard to imagine a situation where this would be a worthwhile endeavor for a business. Also, this is a project that has to be approved.

A project’s likelihood of generating the revenues necessary for survival and expansion increases when the project profitability index is more significant than one. If you’re trying to figure out which projects are worth pursuing and which you should pass on, the Project Profitability Index is a valuable resource to have at your disposal.

How do you calculate a project’s profitability index?

The project profitability index (PPI) measures the financial performance of a construction project. It is calculated by dividing operating cash flows’ net present value (NPV) by the initial investment.

If the index is less than 1: The project has negative cash flow, which means there are more overhead costs than benefits from the project. The NPV is negative, and there may be many reasons why this occurs, such as poor timing or poor estimating skills.

If the index is equal to 1: The project has zero cash flow or only nominal profits or losses (e.g., if you receive $100 in year one but pay $100 in year two). This means that this project has no profits or losses; it’s just a wash.

If the index is greater than 1: The project has positive cash flow, which means there are more benefits than costs from this project.

Understanding Profit Margins for Project Management

One of the most important things to understand about profit margins is that they can vary from industry to industry and even within the same industry. In some industries, for example, it’s common for a company to have a lower margin than others. If you’re part of this industry, you need to find ways to increase your profit margins.

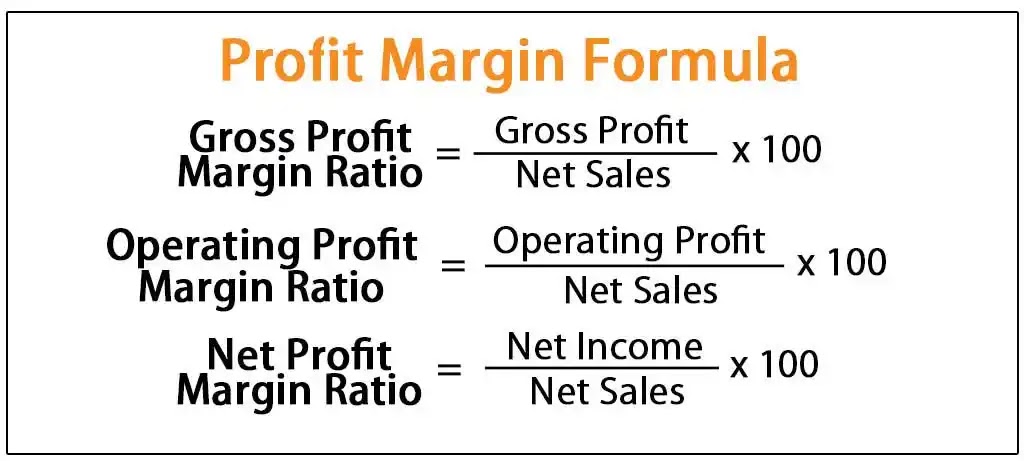

Understanding profit margins for project management is crucial to the success of any business. Profit margins are one of the leading indicators that show whether a business is making money or losing it. While there are many ways to measure profit, understanding your project’s profitability is essential if you’re going to succeed as a project manager.

What is a good profit margin?

A reasonable profit margin is enough to cover the costs of a project and provide net income for the investors.

The profit margin is a measure of how efficiently your business produces value. A high-profit margin indicates that you’re earning more than you spend on each dollar of sales, while a low-profit margin means you’re losing money or barely breaking even.

The best way to determine this is by comparing the project’s cost with its selling price. A project with a 15% profit margin would be profitable if its selling price were 1.15 times greater than its cost.

To determine whether a project is profitable, you need to know the total cost of completing the project, including all labor and materials. This includes everything from blueprints and permits to building materials and equipment rental fees.

Once you know what it costs to complete the project, compare that figure against how much money you make during construction. You can calculate project profitability by simple math: Revenue – Cost = Net Profit Margin.

For example, if your client asks for a $10,000 design fee, but you charge them $12,000 because you know they can afford it and you need to make a profit, your project has a 12% profit margin. If they pay $10,000 for it and you have to pay $8,000 out-of-pocket (not counting staff costs), your project has an 8% gross profit margin.

Increasing profit margins

Construction managers need to understand how profits are calculated in the industry. The most common method of calculating profits is the percentage of completion method. This is also referred to as the “percentage of contract price” method or “percentage of physical progress.”

The percentage of completion method relies on comparing estimates of costs at various project stages with actual costs incurred to date. The profit expectation is calculated by adding all expected costs and dividing by total expected costs.

Similarly, the estimated cost to complete (EFC) is determined by subtracting actual costs from EAC. Profitability can be measured by subtracting EFC from EAC, yielding an estimated residual value (ERV) amount. ERV represents the amount that must be collected from clients before closing a project and incurring losses due to uncompleted work.

The most important thing to remember when calculating project profit margins is that they’re based on estimates; there are no guarantees that actual costs will match estimates at any time during construction. It’s not uncommon for exact costs to exceed estimates during a project because unforeseen circumstances arise or materials become more expensive than expected.

Conclusion

There are various ways to track progress, measure profitability and ensure that your business is doing well. In construction and real estate, it can be difficult for owners to ensure everything is proceeding well. With all the permits and focus on legal implications, there are many reasons that a simple project may get turned around. It doesn’t help if contractors have given you incorrect information or your lawyer has failed to provide you with the correct advice.

Looking at your profits and losses throughout the project will help you track how you’re doing about where you should be. It will also make things easier when figuring out what went wrong or who was responsible when you had an unexpected shortfall in profits or operating expenses.

By keeping track of your business’s expenses and profits using Epiprodux, you’ll be better able to make informed decisions about what kinds of project to invest in moving forward.