Launching a startup is a challenge for even the most seasoned entrepreneur — but making it a success may seem impossible. Around 90% of new startups fail, with 82% of failures due to cash flow problems.

Preparation is paramount to understand your chosen market and your target audience before you try to make an impact, even in a small niche. Consumers have more purchase options than ever, and your startup must provide them with something they can’t get anywhere else. That might be your products, your prices, or some other aspect of your service.

And a significant aspect of good preparation is knowing how to estimate market size, making intelligent decisions that contribute to success. This is where TAM, SAM, and SOM come in.

Have no idea what any of those terms mean? Don’t worry — EpiProdux is here to explain it in detail. Read on for all the TAM, SAM, and SOM information you need to understand the market size and grow your startup.

What is Total Addressable Market (TAM)

Total addressable market or TAM for short is a technique for determining the total market to a business. The number allows businesses to define the total potential revenue from their business, product line, or service. If you understand the total opportunity, you can reverse engineer an acceptable level of effort and funding for the business or product.

How to Calculate TAM

There are various methods that can be used to calculate the TAM for a business or new product. The best technique will depend on your offering, your business model, and your audience. However, you should work through the following steps:

-

Understand your target market

Before calculating your TAM, the first step is to understand your target audience. You need a clear picture of your buyers, your users, their demographics, location, income level, and so on.

Here’s a real-life example. An American fashion brand is launching a new line of sportswear for pregnant women. The brand’s target audience will naturally be US-based women who are either pregnant or planning to become pregnant in the near future.

-

Analyze your current target audience

Now it’s time to conduct some research. You need to find out how many women in the USA give birth each year. You need to learn the age range for these women, whether particular locations have higher or lower birth rates, are there trends in the demographics of women giving birth in each location, and so on?

A quick search online shows that in 2019, there were 3,747,540 births in the USA. What’s more, the birth rate is highest between the ages of 15-44 years (58.3 births per 1000 women).

-

Incorporate your pricing

The next step in calculating your TAM is to incorporate your pricing model. Let’s assume your maternity sportswear is a premium brand, costing $100 per legging.

TAM = Total number of US pregnant women * your retail price

TAM = 3.5 million * 100 = $350 million

Based on this calculation, you can assume that your TAM is $350 million IF 100% of your target audience bought a pair of leggings.

Serviceable Available Market (SAM)

SAM is your TAM segmented by the number of people you can really get to purchase your product. In other words, it’s a smaller segment of your total addressable market that you can reach or achieve.

Let’s go back to the maternity sportswear example. Here we assumed that the total market size for pregnant women is 3.5 million. However, as this is a sports brand, we can dig further and find out that only 23% of Americans exercise on a regular basis.

This leads to this assumption that 23% of 3.5 million pregnant women (approximately 800,000) would make up the SAM.

Based on this smaller segmentation, we can calculate the SAM like this:

SAM = Total number of US pregnant women who also exercise * your retail price

TAM = 800,000 * 100 = $80 million

Serviceable Obtainable Market (SOM)

SAM is the smaller segmentation of your audience that realistically could purchase your product. The SOM is the subsection of this audience that you are going to attempt to sell to.

SOM for established companies can be calculated by using your last year’s revenue. However, for startups, this isn’t possible, so you will need to make some more assumptions.

You can assume that:

- Your competitors will take 50% of the SAM

- Out of the remaining 50%, you will attract and convert 5% as early adopters

We can, therefore, calculate the SOM like this:

SOM = SAM * 50% (5%) = 2 million

How Brands Use Market Segmentation to Identify the Right Products

Market segmentation is critical to understand the different types of consumers within a market. It’s doubtful that your startup will target one kind of customer with your products or services — your audience will probably comprise people with diverse incomes, interests, lifestyles, and ages.

Segmenting your target customers will help you recognize each type of customer’s pain points, goals, and needs. Some of the world’s biggest brands utilize market segmentation to identify the right products and guide their decisions.

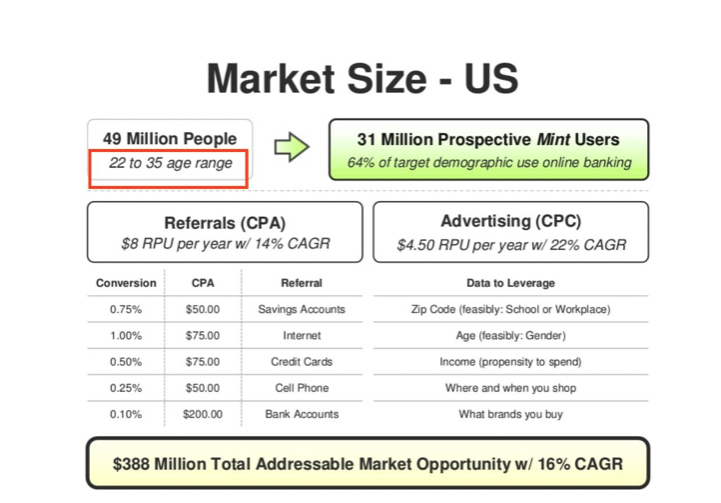

Mint

When the finance management platform, Mint, started in 2007, too many possible market segments could benefit from it, including students, parents, graduates, corporates, and business owners.

However, the people behind Mint realized that marketing to all these prospects without reducing the value proposition for their product and presenting it as an all-in-one solution would be nearly impossible.

So, what did they do instead?

Source: https://buildsuccessfulstartups.com/market-segmentation-examples/#Example

They carved out a segment of the entire market and decided that the ideal segment was 22-35-year-olds. In this way, they managed to target specific potential customers by adapting to their needs and using phrases like:

Use this finance software to move towards your millionaire journey in your 20’s!

Consequently, getting specific with market segmentation increases sales and conversions way more effectively than anticipated.

Nike

The global apparel market was worth $1.5 trillion in 2020. But this comprises countless companies competing for consumers’ money across a massive range of markets, encompassing different geographies, genders, styles, and other diversifications. There’s no way a single brand could ever achieve 100% TAM in this industry.

However, a company could account for a sizable share of a specific market (e.g., women’s clothing and accessories). Nike held almost 3% of the global apparel and footwear market share in 2017, followed by H&M, Zara, Levi’s, Under Armour, and other major brands. While only holding a small percentage of the market, Nike and these other leading companies would still generate immense revenue.

How You Can Avoid Costly Mistakes and Develop the Right Products

Relying on assumptions and guesswork can lead to mistakes that waste time, money, and resources. Using hard facts to develop and market your products will help you resolve target customers’ pain points and effectively gain a competitive edge.

And EpiProdux brings you the tools to conduct comprehensive market size research and analysis.

This innovative platform features multiple areas that help you build the right products for the right customers and market them with the right campaigns. The Markets section is home to three areas:

- Details

- Market Size

- Validation

We’ll focus on the second section here.

EpiProdux’s Market Size analytical tools enable you to calculate your Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM) efficiently.

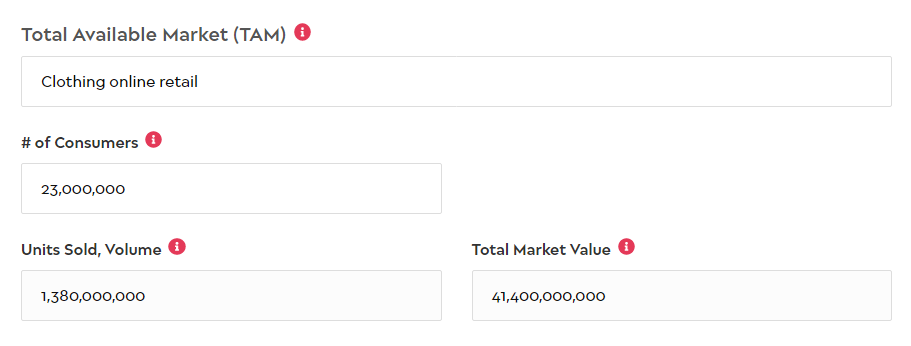

Total Addressable Market (TAM)

The Total Available Market section makes identifying your TAM simple: just describe your TAM and attributes, then enter the total number of consumers based on your customer’s segment characteristics (e.g., gender, age). You can calculate the volume of units sold and the total market value.

For example, we have an online clothing store with a subscription-based model with a monthly purchase frequency and five units sold per purchase.

If we had 23,000,000 consumers, the volume of potential units sold would be 1,380,000,000, and the total market value would be 41,400,000,000.

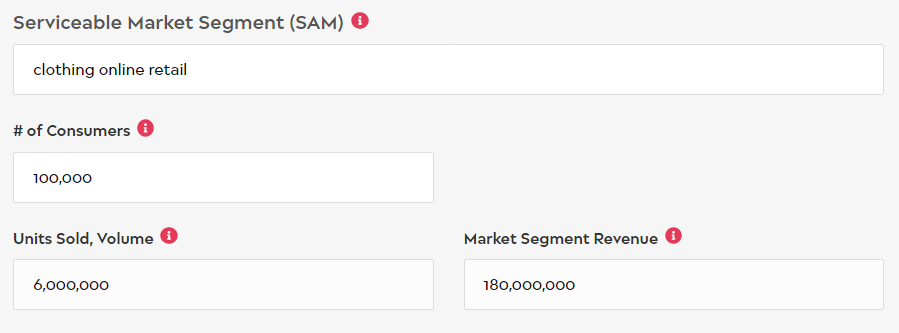

Serviceable Addressable Market (SAM)

In the SAM section, describe your SAM segment and attributes. Add the number of consumers, then calculate the volume of units sold and market segment revenue to work out your Serviceable Addressable Market.

To continue the above example, the SAM volume of units sold would be 6,000,000 and the market segment revenue $180,000,000.

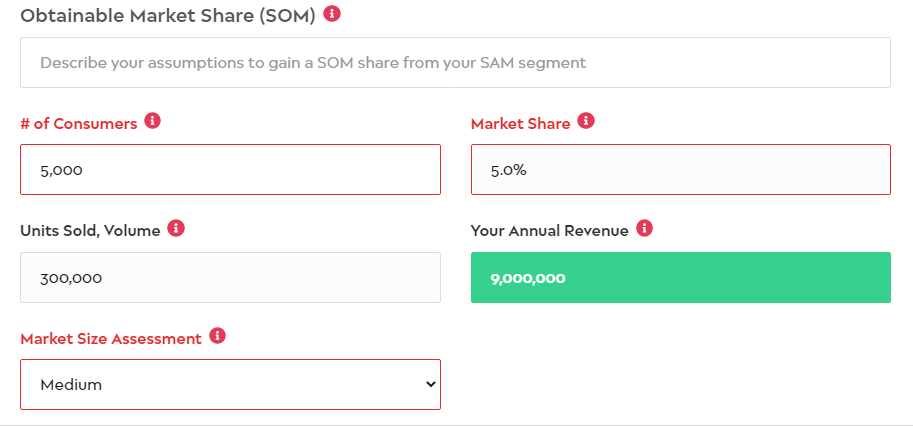

Serviceable Obtainable Market (SOM)

Finally, in the SOM section of the EpiProdux Market Size area, start by describing your assumptions to get a SOM share from your SAM segment. You can calculate the number of consumers, volume of units sold, market share, market size assessment, and your annual revenue.

So, if we believed we could win 5,000 consumers, we could secure a 5% market share and achieve annual revenue of $9,000,000.

All this helps you work out the maximum potential revenue available within your startup’s market and dig deeper to discover how much you can realistically expect to capture within your first year (and beyond).

You can present investors and stakeholders with data-driven projections across TAM, SAM, and SOM, so they know what they can expect of your brand.

Conclusion

Estimating your TAM, SAM, and SOM is essential when launching a startup. You’ll develop a better understanding of the potential risks and profits you face.

You can also use EpiProdux for streamlined market segmentation that empowers you with insights into different segments within your market, so you can deliver products consumers want and need.